Keeping track of your direct debits can be tricky and time-consuming. PayTo lets you take control.

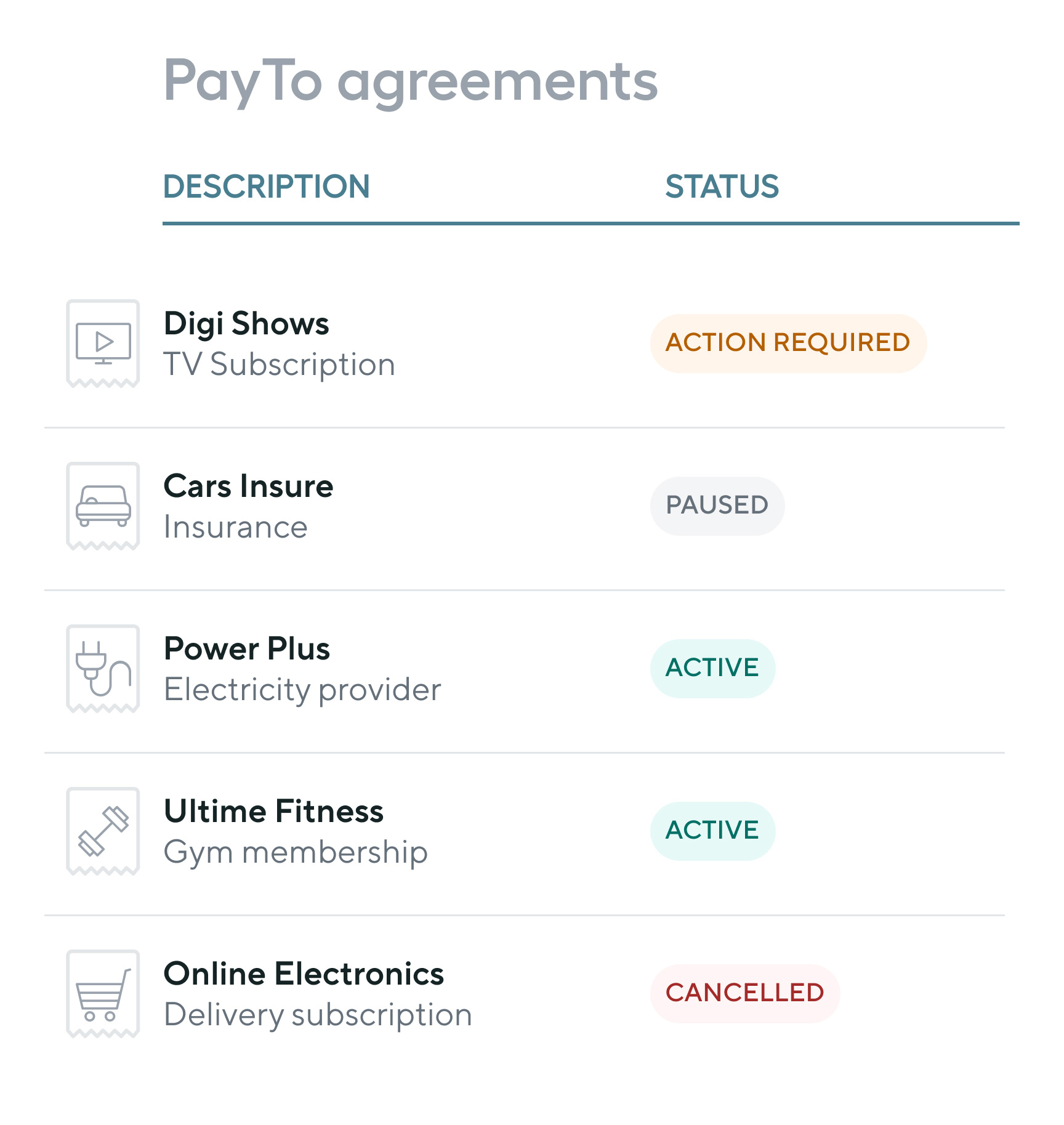

PayTo allows you to authorise and manage direct debit payments from participating businesses, quickly and easily in online banking.

View your gym membership, TV and music subscriptions, energy bills, and more all in the one secure place – and always know when funds are leaving your account.