When you’re getting a loan to buy a property, the loan to value ratio (LVR) is an important factor to consider. It helps determine what type of loan you might be eligible for and what additional costs you might have to factor in.

What is LVR?

LVR is the amount you’re borrowing shown as a percentage of the lender’s valuation of the property. The higher the deposit you have, the lower your LVR will be.

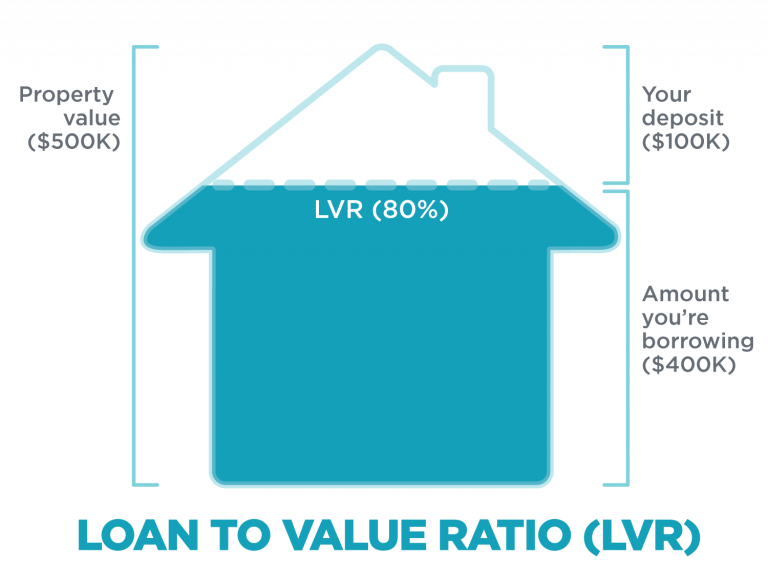

For example, if the property is valued at $500,000 and you want to borrow $400,000 (i.e you have a deposit of $100,000, or 20% of the property’s value), the LVR would be 80%.

Here's an example:

What is LVR used for?

Lenders use LVR to assess the risk that comes with issuing a loan. Generally applicants with a bigger deposit (and a lower LVR) present a smaller risk, as they have less to pay back on their loan compared to borrowers with a higher LVR.

Because of the higher risk, borrowers with an LVR over 80% will need to pay for Lenders’ Mortgage Insurance (LMI). This insurance protects the lender (not the borrower) in the event that the borrower cannot repay their loan. The cost of LMI can be added to your loan amount so you don’t have to pay it all up-front.

As well as this, your LVR may help decide whether you are eligible for a certain type of home loan at all. Many loans come with a maximum LVR - for example, the maximum LVR for a home loan might be set at 80%, meaning the borrower would need a deposit of at least 20% of the property’s value.

Reach your dream of homeownership sooner with bonus interest on your savings. Apply here.

What’s the ideal LVR?

This depends on your own circumstances. But as a general rule, the lower your LVR is, the better. Having a larger deposit means you own more of your property from the start, with less to pay off. It can also mean you have less interest to pay on your loan.

As discussed already, if your LVR is 80% or lower, you won’t need to pay for Lenders' Mortgage Insurance, which can be a big saving for home buyers.

Looking for more information?

If there’s any other aspect to buying a home that you’d like to know more about, we can guide you through it. Whether it’s help with a loan application or pre-approval, or just discussing your plans with an expert, our Home Loan Specialists are here to support you along the way.