Offset accounts explained

If you’re one of the many Aussies considering buying a home at the moment, you may have come across the term “offset account”, as well as a heap of other home loan terms. It’s really important to know what these terms mean – especially if you want to save yourself some time and money. For example, an offset account is something that could save you thousands of dollars in interest and help you pay off your home loan sooner.

What is an offset account?

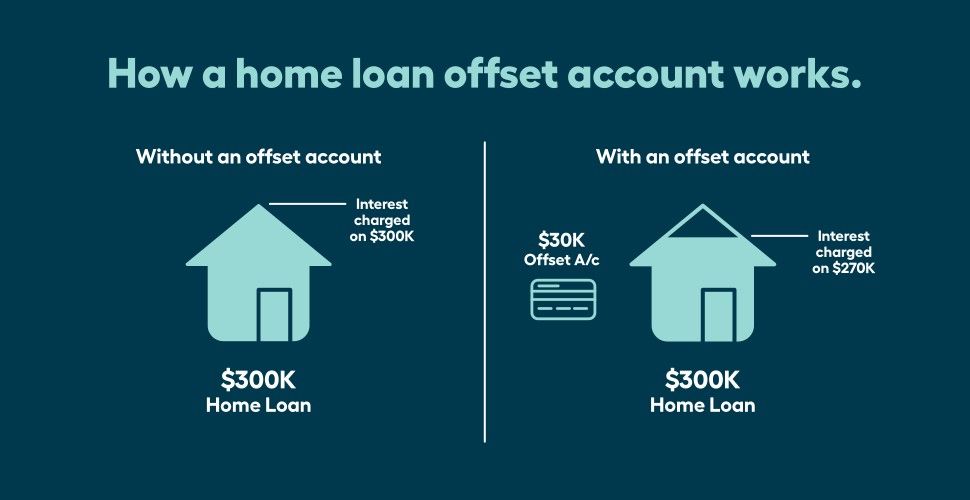

In simple terms, an offset account allows you to use the balance of a linked transaction account to “offset” (or reduce) the balance of your home loan that interest is charged on.

How an offset account works?

Let’s say you have a home loan balance of $300,000 and have $30,000 in your offset account, you'll only pay interest on a home loan balance of $270,000. This can save you money on interest over the long term and help you pay off your loan sooner.

When should you offset your home loan?

If you have some savings that you may want to put towards a renovation, school fees or something else in the future, those funds can work harder for you offsetting your home loan, rather than sitting in a savings account – especially at the current time with low savings interest rates available.

Plus, your home loan interest rate is often higher than a savings account. And, unlike interest earned in a savings account, the interest savings you make by offsetting your home loan are tax free.

Benefits of an offset account

There are a few advantages that come with an offset account.

- An offset account saves you money

With an offset account, you’ll save on the amount of interest you’ll be charged. Because you’re using money in one account to offset the balance of your home loan that interest is charged, you’ll pay less in interest.

- Own your home sooner

Offsetting your home loan can help you pay less in interest and more off the principal amount you owe with each principal and interest repayment. This means you can pay off your home loan faster and own your home sooner. Win, win!

Everyday Account offers lots of great features and benefits to help make your everyday banking a little easier. It's a transaction account that you can request to be linked to offset your eligible home loan.#

3 clever ways to use an offset account to pay off your home loan sooner.

Deposit your salary into your offset account

By depositing your salary straight into your offset account, your salary is working harder for you, as interest savings are calculated daily for offset accounts. Put all of your purchases on your credit card each month

Using a credit card throughout the month for all your expenses helps you keep more money in your offset account each day, saving you more on home loan interest. However, you must be disciplined and pay off your credit card in full each month to avoid credit card interest charges.

Put any savings straight into your offset account

While you may think a savings account will earn you more interest, your home loan is likely to have a higher interest rate. This means you could save more interest on your home loan than you would earn in a savings account. So put any bonuses, cash gifts, and even your tax refund into your offset account as soon as you can.

How much do you need for an offset to be of benefit?

Having a lazy $50,000 to $100,000 lying around to offset your home loan would be nice (really nice) – but that’s going to be unrealistic for most home buyers. So, what is a good amount to offset your home loan? How much do you need to have to make it worthwhile? Because an offset account can save you a lot of interest, most lenders charge a package or monthly offset account fee.

The Sydney Morning Herald found that having at least $10,000 in an offset account would cover the costs of the average annual offset fee of $450 charged by larger lenders. Anything above that would certainly chip away at the amount of interest you pay.

Things to look out for:

100% or partial offset

Offset accounts can be 100% or partial offset. Make sure you check that the full value of your linked account is offset against your home loan, not just a portion of it. Look for home loans that feature 100% offset and you'll know that every dollar in your offset account is working hard to save you money.

One or more offset accounts

While some banks only allow you to have one linked offset account, Great Southern Bank offers you the ability to have multi-offset accounts, so you can offset 100% of the combined balances of multiple Great Southern Bank Transaction accounts* against your eligible home loan. It means your wedding, new car and holiday savings can all be kept separate, but still help you save on interest and pay off your home loan sooner.

*You must maintain a minimum balance of $500 in each offset account to obtain an offset benefit. You will not receive any interest on the funds in your offset accounts.

Great Southern Bank, a business name of Credit Union Australia Ltd ABN 44 087 650 959, AFSL 238317. Conditions, fees and charges apply. This is general information and does not take into account your objectives, financial situation or needs. Consider the appropriateness of the information, including the Terms and Conditions (T&Cs) booklet, before acting on it. The Financial Claims Scheme may apply to this product; refer to the T&Cs for more information.

Contact:

Phone:

Email: