Dealing With the Financial Impact of Divorce

Separation and divorce can get messy. There can be a lot of emotions involved, you may have children that you need to consider, and of course you’ll need to make new arrangements such as who remains in the house and who leaves.

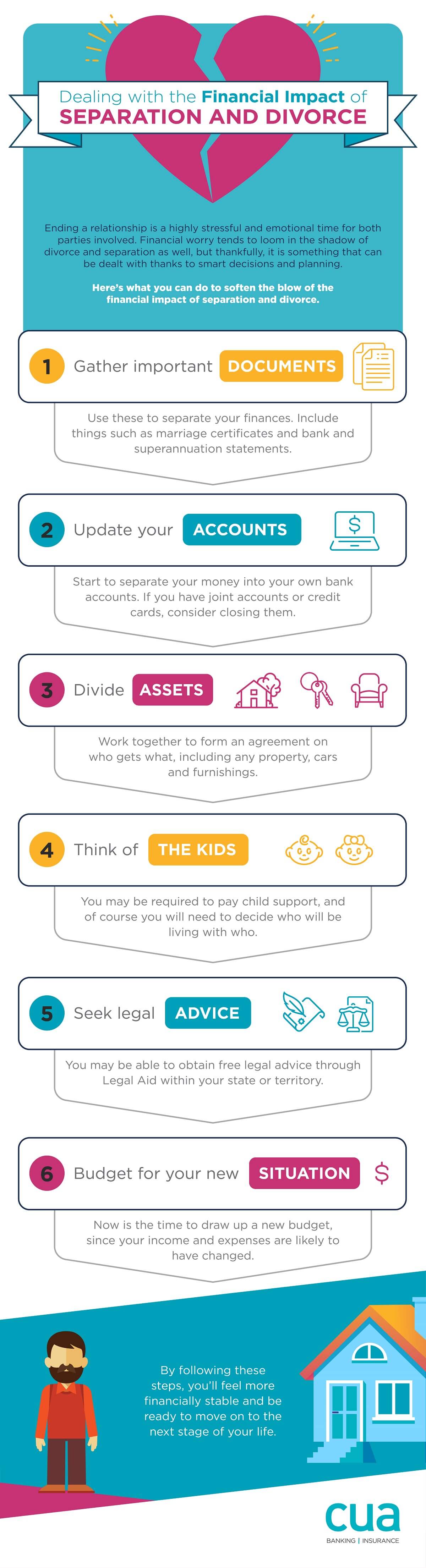

Then, there’s the financial impact of divorce – seeking legal advice, dividing assets and adapting to a new income can all be very challenging. If you’ve been wondering how assets are split in a divorce, as well as how to make financial arrangements during a divorce, we’ve put together some important information for you.

How divorce works

Divorce is granted at a court level after 12 months or more of separation, or when a marriage is deemed irretrievably broken. A divorce that goes uncontested usually involves paperwork containing important information such as property ownership and child custody, along with a statement that determines the grounds for divorce.

Breakdowns of de facto relationships (where two people live together as a couple but aren’t married) are subject to many of the same conditions that apply to a divorce. The only difference is that people in de facto relationships usually don’t have to go through a formal process to separate. Conflicts in de facto relationships can still be dealt with by the family court.

If the divorce is contested, both parties may need to attend a court hearing to determine temporary orders. If possible, it’s important to try and negotiate with the other party before contesting a divorce. This could save you time and legal fees. Even if it’s only in the short-term, agreeing on practical matters will make proceedings less stressful for everyone involved.

Living arrangements

Staying under the same roof as someone you intend to separate from can be less than ideal for your mental health. However, some people can make this work. Both parties should agree on new living arrangements as soon as they decide to formally separate.

Children

When parents separate it can be unsettling for children, which is why it is so important that they feel supported and loved during this time. An agreement will need to be reached on where the children will live and how they will be financially supported.

Joint bank accounts and credit cards

Decide what to do with money held in shared accounts or on credit cards. How is this equity divided in a divorce – will you choose a 50/50 approach, or come up with another arrangement?

Preparing financially for a divorce

If you’ve made the difficult decision to separate, these are some of steps you can take to start preparing for divorce proceedings:

Gather important financial documents

This includes bank account details, mortgage and credit card statements, tax returns, superannuation and shareholdings. These documents will help you later when it comes to negotiations during the divorce.

Create your own budget

After a divorce, your financial responsibilities will fall back onto you. Create a budget in order to steer your financial decisions and outline your cost of living outside of married life. When doing this, take into account all of your assets and outstanding debt.

Establish your own bank account

Many couples share a joint bank account, but a divorce means that you will need to be able to be financially independent once more.

How are assets split in a divorce?

Dividing assets is one of the most challenging parts of a divorce. Assets aren’t always split 50/50, and a couple’s unique circumstances can determine who ends up with what. This is because a lot needs to be taken into account before asset ownership is decided; everything from age to health and past and current incomes will be looked at. Depending on the experience of your lawyer, you may end up with more or less than you expected.

Once you have worked out your combined assets, the contribution that each party made to the assets is assessed. This assessment includes financial contributions, parental contributions, the age and health of each party, their earning capacity, and which party will have primary care of any children. A court will then decide if the division of assets meets the “just” conditions of the Family Law Act.

Obtaining legal advice

Lawyers and solicitors can be an expensive part of the divorce process. Financial agreements must go before the courts before they can be finalised. If the parties involved can’t reach an agreement, you may need to consult a family lawyer (this can be very costly). You might be able to access free legal advice via your state’s Legal Aid agencies, which can help you with decisions regarding your assets, outstanding debts, children and living arrangements.

Making plans for your children

Not only is the emotional welfare of your children very important during the divorce process, but so too is how they will be financially supported once your marriage has ended. Decisions should be made in regards to how their education will be funded, as well as parenting arrangements and parenting plans. Child support may also need to be arranged with a lawyer.

While we cannot prepare for every major event in our lives, having a general understanding of the way your finances will be affected when they happen is important. CUA’s guidance articles can help you with your money, health, happiness and so much more.

Contact:

Phone:

Email: